First published on: Wed Nov 18 2009 17:12:05 GMT+0800

Christmas is just around the corner and traditionally, the final two months of the year will witness many consumer companies offering sales promotions in anticipation of the Christmas shopping season.

Not surprisingly, these consumer-focused firms will use a combination of discounting (inventory clearance) and force bundling of multiple products (perception of value for money) to encourage the budget-conscious Singaporean consumer to open their wallets. For example, one of Singapore’s leading retail store, John Little, is holding a Christmas Sale at the Singapore Expo Centre from 18 to 29 November 2009.

Clearly, the clouds of pessimism that greeted Singapore at the start of the year is showing signs of clearing as Nielsen reported a rise in consumer confidence in a survey done in October 2009. We should not be surprised to see consumers finalizing their Christmas shopping list as they begin to receive the latest Christmas promotional advertisements in their email inbox.

One item which is likely to feature at the top of the shopping list for Starhub and M1 subscribers is the Apple iPhone 3GS. Following their successful negotiations with Apple to secure the distribution rights for this iconic product, they are now accepting pre-orders which I believe will be available by the Christmas period.

As a Starhub subscriber, I have opted to reserve a set for myself as I wait for their price plans that are presumably tailored for the iPhone (just like SingTel when they released their handset in early 2008).

The only red herring is the possibility of Apple not being able to supply the necessary units to satisfy the worldwide demand of this product. After all, Singapore is NOT the only country in the world with a supposedly insatiable demand for the Apple iPhone 3G and there was an initial period where the exclusive distributor, SingTel, was not able to meet the overwhelming demand for the handset in Singapore.

I was curious to know if there is still any room to grow the Apple iPhone 3G user population in Singapore. Predictably, there is no breakdown in the number of units sold by the then-exclusive distributor, SingTel, following the handset’s debut on 22 August 2008. As such, I relied on publicly available information and undertook a simple, unscientific investigation to satisfy my curiosity. The investigative process is illustrated below:

Step 1:

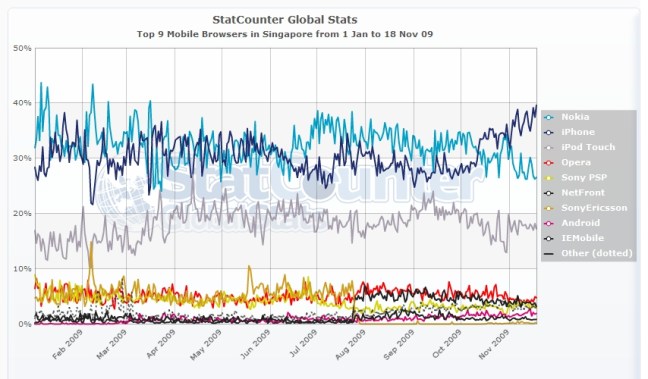

One of the primary applications of the iPhone 3G handset is the pre-installed Safari mobile browser which allows user to access the Internet on their handset. Accordingly, any iPhone user that accesses the Internet with the browser will send the browser’s information to the destination website. In this instance, the website owner can differentiate the browser types accessing their online site, giving them the information to adapt their content to meet the formatting needs of the various browsers in the market today. Using the same browser information captured by websites today, we can estimate the market share of mobile browsers in Singapore accessing the Internet:

Source: StatCounter Global Stats – Mobile Browser Market Share

The line graph above shows a brutal battle between Nokia (all models) and the Apple (just the iPhone) as users access the Internet on their handsets. For example, more than 39% of all mobile browsers accessing the Internet comes from the iPhone on 18 November 2009. In contrast, Nokia’s mobile browsers (presumably Symbian) constitutes slightly less than 27% on the same chart.The other handset models are clearly not used by their owners to access the Internet, suggesting that they are primarily voice-call users. However, this chart is far too granular for me to extract meaningful information from the chart. I then changed the graph’s layout to a bar chart:

Source: StatCounter Global Stats – Mobile Browser Market Share

This is much better. The above bar chart is showing an annualized browser market share since the 1st of January 2009. This is clearly more useful vis-a-vis the line graph above as I am now able to extract the percentage share of all mobile browsers in Singapore. In this instance, Nokia’s has a indicative mobile browser market share of 32% while the iPhone has a 30% market share. This sounds reasonable as Nokia has released multiple handset models which are capable of accessing the Internet since the launch of 3G services in Singapore in late 2004.

Step 2:

Since we now know that 30% of all online mobile traffic is attributed to iPhone users in Singapore, we can make a conservative assumption that the same percentage (i.e. 30%) is applied to Singapore’s mobile market. In this instance, the mobile market universe is based the number of 3G subscribers in Singapore. More importantly, we have to use the entire 3G subscriber population in Singapore, which includes Starhub and M1, as there are avenues for a non-SingTel subscriber to use the iPhone by buying the handset at inflated prices from the secondary market (though prices are expected to drop following the announcement of Starhub and M1 to distribute the handset).

Concurrently, we are excluding all 2G subscribers as the target audience are predominately voice-call users. Hence, it is highly unlikely that these subscribers will invest in a relatively expensive handset with the primary intent to make voice-calls.

As such, the percentage of mobile browsers (described in the earlier chart) represents the mobile handset mix used to access the Internet. Therefore, it is a conservative assumption that 30% of all 3G subscribers are using the iPhone to access the Internet.

Step 3:

According to Info-communications Development Authority of Singapore (IDA), there are 2,927,700 3G subscribers in Singapore (pre-paid and post-paid).

Using the above numbers, we can now make a conservative estimate that there are 878,310 iPhone users in Singapore. Clearly, this number highlights the high probability that there are many non-SingTel users who own the iPhone. According to SingTel’s FY10Q2 results which ended 30 September 2009, the mobile operator has 1,426,000 3G subscribers (I am unable to differentiate 3G pre-paid users from the financial results). If this is the case, that will suggest that more than 60% of all SingTel subscribers are iPhone users. That percentage does not make sense to me and confirms my belief that there are already Starhub and M1 subscribers who are using the iPhone as their primary mobile handset.

So how many more iPhone users can Starhub and M1 add to the already more than 800,000 iPhone population in Singapore? It is very unlikely that SingTel users will convert their subscription to either Starhub or M1 for the purpose of owning a iPhone handset. This is because SingTel was the exclusive distributor and any of the operator’s subscribers seeking to own the device can only purchase it from their incumbent operator. Hence, it is safe to say that any SingTel subscriber who wanted to own the iPhone would have purchased the device and is contracted over 2 years (for some it is 3 years as they re-contracted after 12 months for another 2 years if they want to purchase the iPhone 3GS). This will mean that any incremental iPhone users following the entry of Starhub and M1 is likely to be their own subscribers.

Based on this argument, I can assume that any subscriber who signed with either mobile operator between 2007 to 2008 (i.e. the maximum contract period when purchasing a subsidized handset from the operator) are the immediate target audience. In addition, I am assuming that these subscribers are unlikely to enter into a contractual agreement with SingTel for the purpose of owning a iPhone handset (i.e. two operator plans running concurrently). Finally, I would presume that any subscriber who signed a 2-year contract in 2009 will need to pay a penalty (e.g. $300) to purchase the iPhone.

Using the above-mentioned assumptions, I looked through the full year financial results of Starhub and M1 for 2007 and 2008. Ideally, I should use the Net Additions metric to be absolutely sure on the number of new subscribers who signed with the operators in the said period. Unfortunately, this metric was not provided consistently in both financial results. As such, I am making an assumption that the change in the number of subscribers for each quarter is an indicative figure of new subscribers who signed with either operator.

Based on the above table, the total number of M1 and Starhub subscribers who have completed their two year contractual relationship with their respective operators is 532,000. It is my opinion that these subscribers are the prime target audience for the operators to promote the iPhone 3G handset.

However, not everyone who is free from their 2 year contractual period will purchase an iPhone. Indeed, the 532,000 subscribers can choose any handset that is available in the market. Hence, I am assuming that 30% of this available subscriber base will purchase a iPhone 3G once it is distributed by Starhub or M1.

Therefore, I am making the case that there will be an additional 159,600 iPhone users in Singapore once Starhub and M1 finally offer the iconic handset (in Christmas?).

Which means that we’re likely to have slightly more than 1.04 million iPhone users by 2010. To put this in its context, the dominant English newspaper in Singapore, The Straits Times, has a readership base of 1.44 million with an average daily circulation of slightly more than 370,000 copies.

If every iPhone user reads The Straits Times, that will mean that every 3 out of 4 reader is a iPhone user.

– Darren –

//